IRMAA Brackets For 2025 And 2025 What You Need To Know

With great pleasure, we will explore the intriguing topic related to IRMAA Brackets for 2025 and 2025: What You Need to Know. Let’s weave interesting information and offer fresh perspectives to the readers.

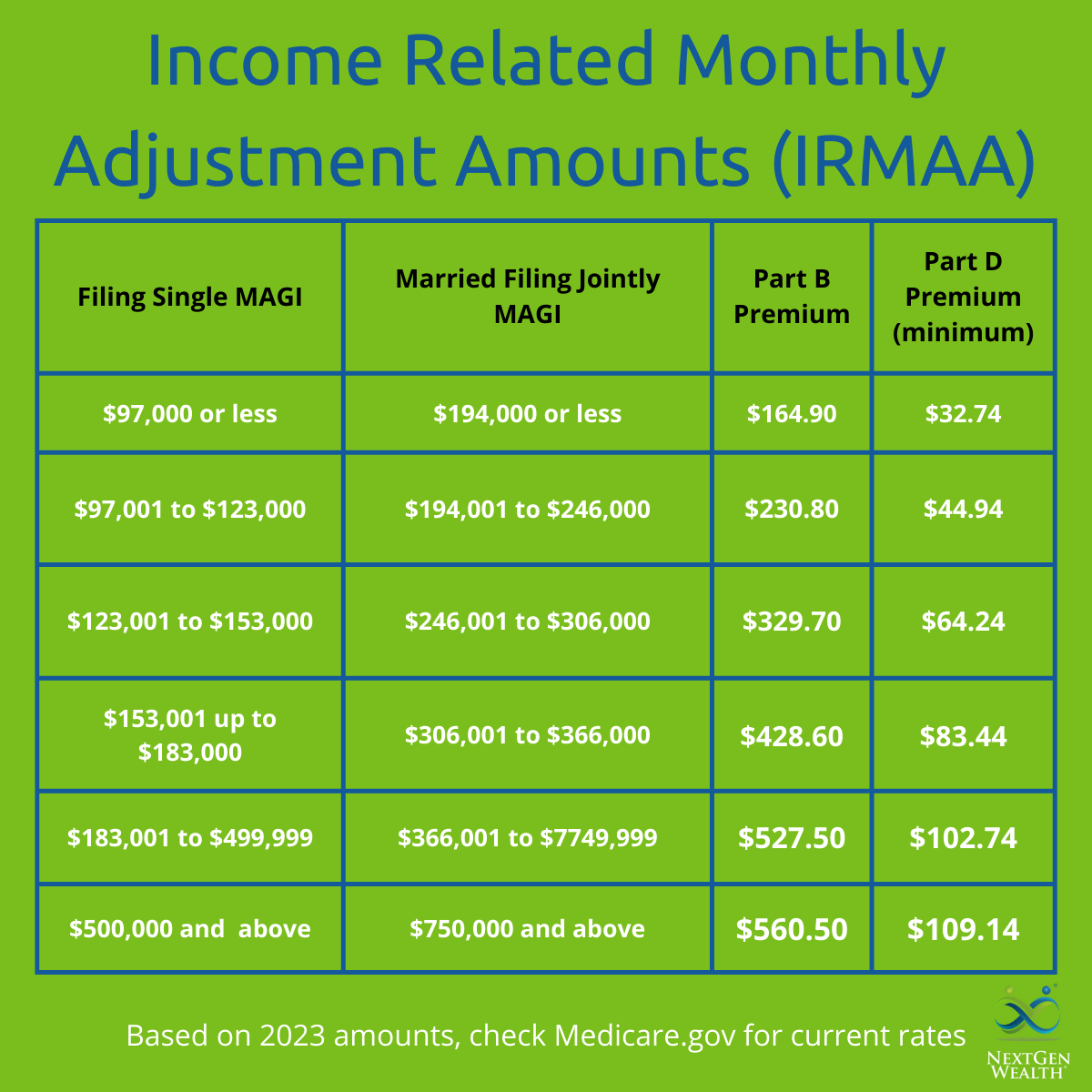

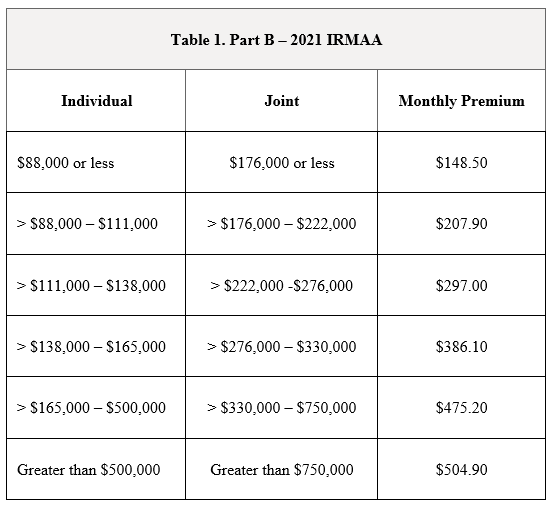

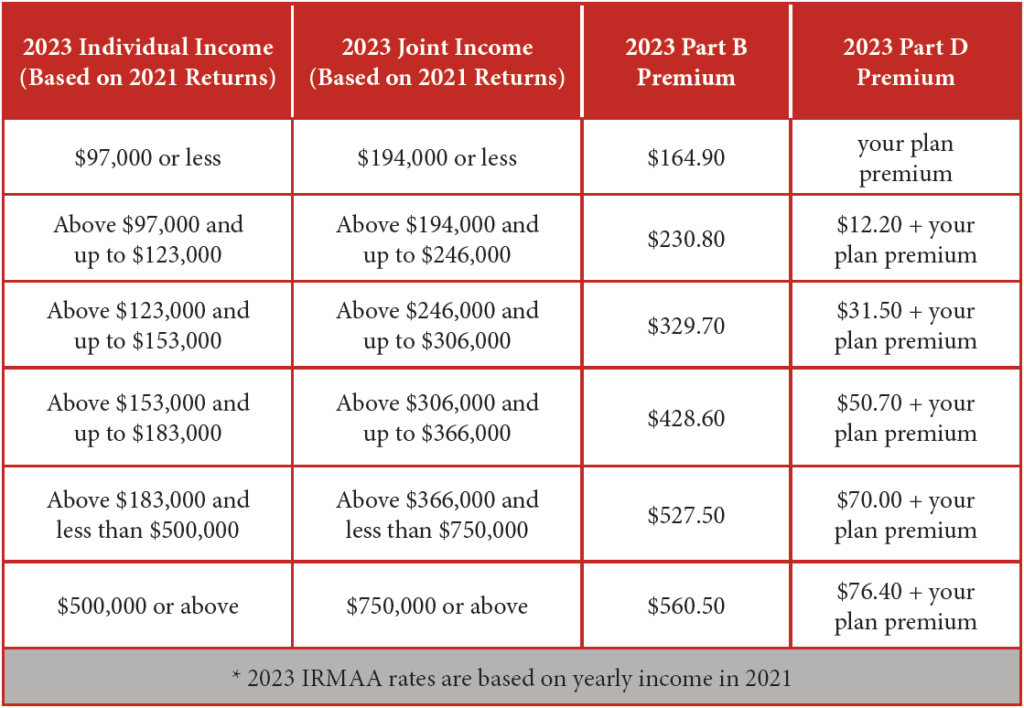

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge that is added to Medicare Part B and Part D premiums for individuals with higher incomes. The IRMAA brackets are adjusted annually to reflect changes in the cost of living. For 2025 and 2025, the IRMAA brackets have been updated, resulting in changes to the amount of surcharge that some individuals will pay.

IRMAA is a way for Medicare to ensure that everyone pays their fair share of the program’s costs. Individuals with higher incomes are able to contribute more to the program through the IRMAA surcharge. The surcharge is calculated based on the individual’s modified adjusted gross income (MAGI), which is their adjusted gross income (AGI) plus any tax-exempt interest.

The updated IRMAA brackets for 2025 and 2025 will result in changes to the amount of surcharge that some individuals will pay. Individuals with MAGIs above the threshold amounts will pay a higher surcharge, while individuals with MAGIs below the threshold amounts will pay no surcharge.

The IRMAA brackets for 2025 and 2025 have been updated, resulting in changes to the amount of surcharge that some individuals will pay. It is important to understand the IRMAA brackets and how they affect you so that you can plan accordingly. If you are concerned about paying the IRMAA surcharge, there are steps you can take to avoid it.

Thus, we hope this article has provided valuable insights into IRMAA Brackets for 2025 and 2025: What You Need to Know. We thank you for taking the time to read this article. See you in our next article!